Be Aware of Clark County Taxes

September 27, 2024

Local Owners May Have Seen an Inaccurate Tax Increase

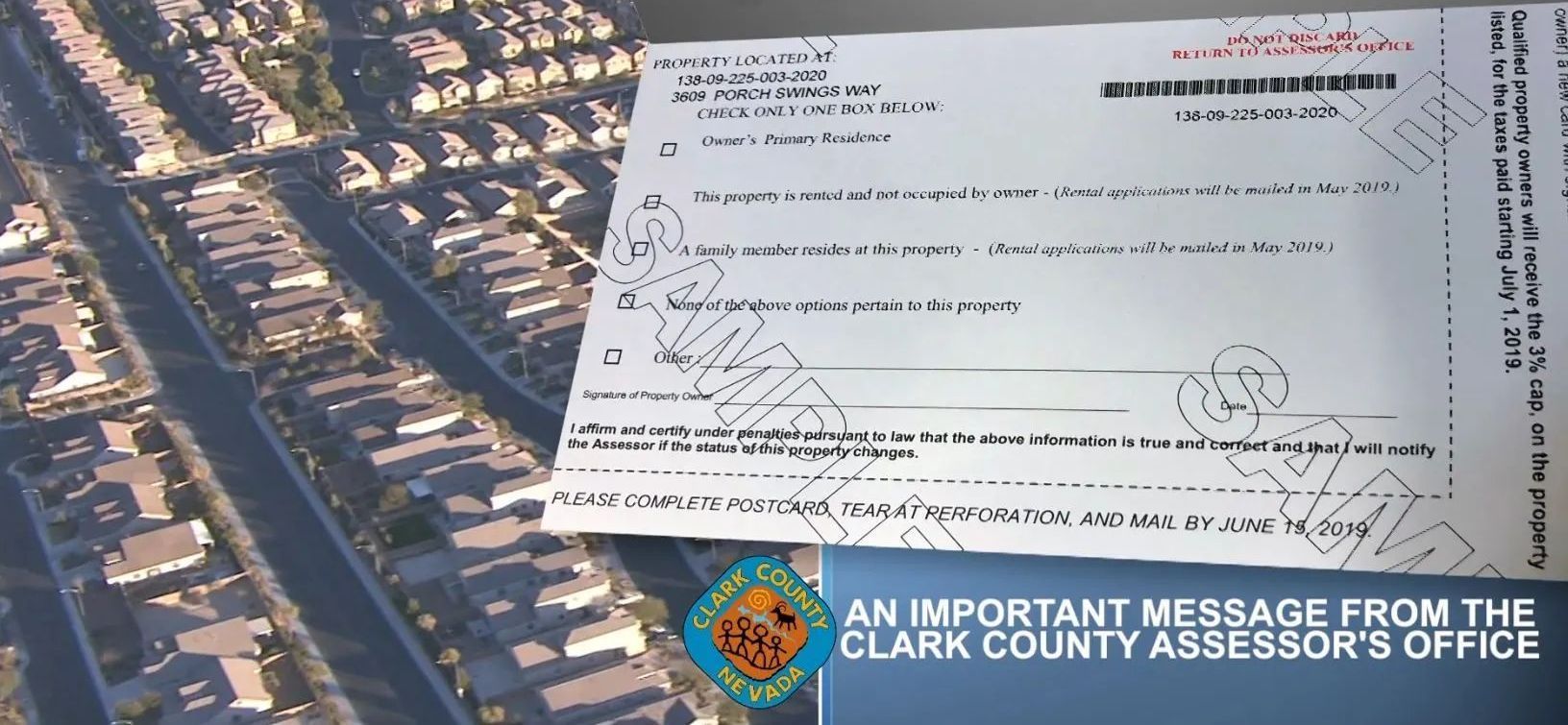

In August, local property owners should have received their annual Clark County tax bill, with the first payment being due at the end of August. Some homeowners may have discovered that the property tax rate on their personal property increased to 8%. This would be reflective of the fact that Clark County levies an 8% property tax on what it determines to be investment properties. If the tax rate on your personal property was increased to 8%, this is most likely the result of not returning the Tax Cap Abatement Notice to the Clark County Assessor's Office that was sent out earlier in the year. This notice asked property owners to verify if the property was an investment property or was their personal property. If this postcard was not returned to the Assessor prior to taxes being levied, the County automatically increased your annual property tax rate to 8%, which is the standard rate used for investment properties. If you are an owner/occupier living in your home in Clark County, the tax rate cap remains at 3% for personal property. This is far below what home values have been appreciating for here in the Las Vegas Valley and should be maintained to prevent skyrocketing property tax costs.

If you have noticed that your tax rate has been raised in error, it is important to handle these tax issues as quickly as possible, so here are some helpful dates to note: Remaining tax installment due dates are October 7th, January 6th, and March 3rd. Payments that are not paid within 10 days of these deadlines will incur an increasing penalty that can quickly add up.

All penalties must be paid at the same time, otherwise payments will not be accepted by the Treasurer. In the event that a mortgage company holds an escrow to pay taxes on your behalf, and you received a bill, Clark County advises that you write your loan number on the bill and send it to your mortgage company. You may want to verify with your mortgage company that the taxes due on your property are being paid on time and in full.

You can check your tax rate cap percentage by visiting the Clark County Treasurer webpage here . If your tax rate cap is incorrect, you can contact the Assessor’s Office at (702) 455-3882 or by visiting their website. Additionally, you may have noticed that the tax bill for this year has been completely redesigned to provide a clear breakdown of the tax information. Clark County has provided a helpful video to explain, which can be accessed here .

If you have noticed that your tax rate has been raised in error, it is important to handle these tax issues as quickly as possible, so here are some helpful dates to note: Remaining tax installment due dates are October 7th, January 6th, and March 3rd. Payments that are not paid within 10 days of these deadlines will incur an increasing penalty that can quickly add up.

- One Installment : Installment amount x 4%

- Two Installments : 1st delinquent installment x 9% + 2nd delinquent installment x 5%

- Three Installments : 1st delinquent installment x 15% + 2nd delinquent installment x 11% + 3rd delinquent installment x 6%

- Four Installments : 1st delinquent installment x 22% + 2nd delinquent installment x 18% + 3rd delinquent installment x 13% + 4th delinquent installment x 7%

All penalties must be paid at the same time, otherwise payments will not be accepted by the Treasurer. In the event that a mortgage company holds an escrow to pay taxes on your behalf, and you received a bill, Clark County advises that you write your loan number on the bill and send it to your mortgage company. You may want to verify with your mortgage company that the taxes due on your property are being paid on time and in full.

You can check your tax rate cap percentage by visiting the Clark County Treasurer webpage here . If your tax rate cap is incorrect, you can contact the Assessor’s Office at (702) 455-3882 or by visiting their website. Additionally, you may have noticed that the tax bill for this year has been completely redesigned to provide a clear breakdown of the tax information. Clark County has provided a helpful video to explain, which can be accessed here .