Las Vegas Housing Market Update - November 2022

Rental Inventory is High, But Shows Signs of Leveling Off

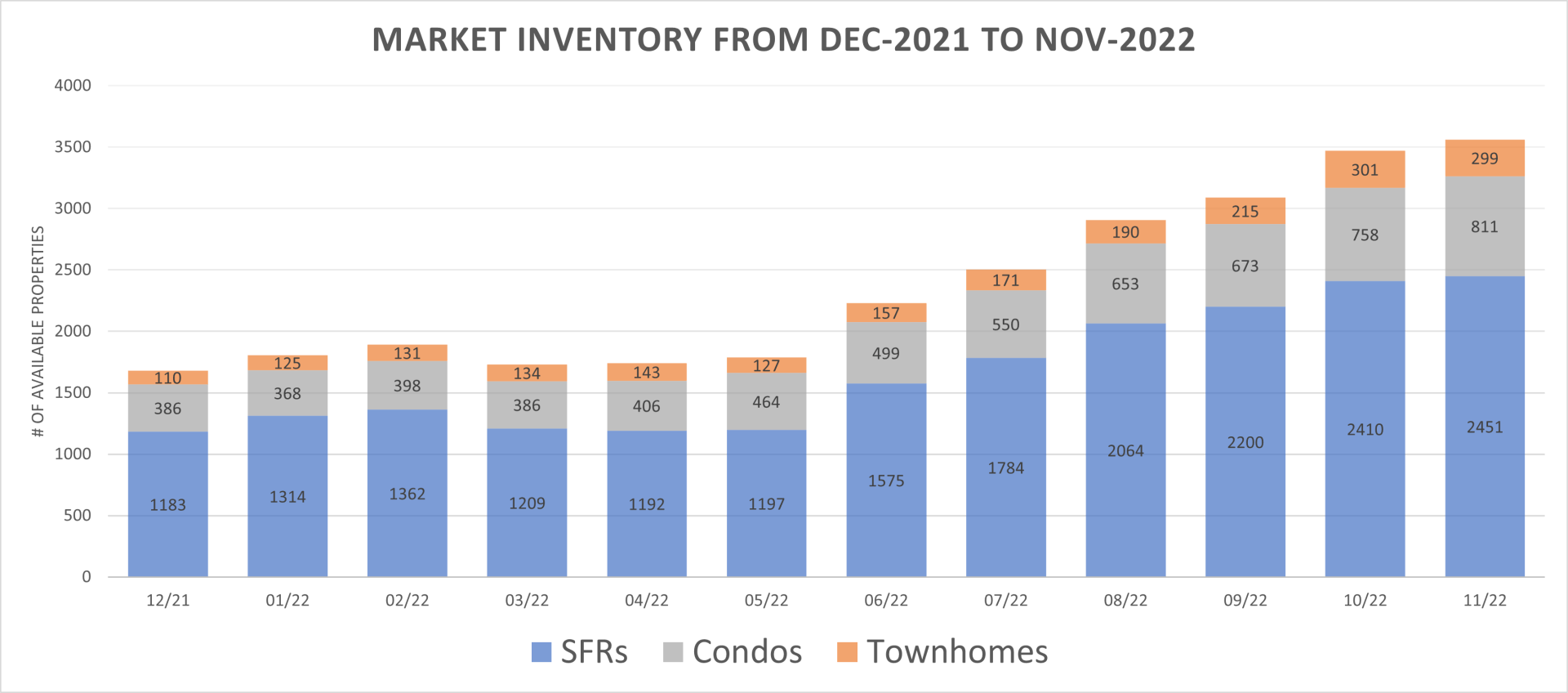

At the end of November, rental market inventory was at 3,561 rental properties. Throughout November, this number peaked near 3,900 active listings, but came back down as we went into the holidays. Although the rental market typically lags behind the real estate market by 18-24 months, both markets have seen large slowdowns in the last couple of months. As we move into the slow season, not much is expected to change in either market.

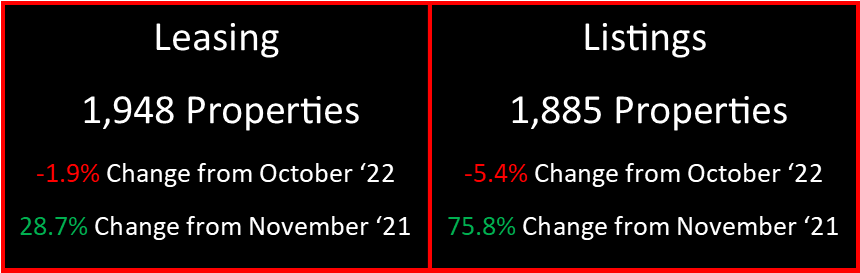

In November of 2022, 1,948 rental properties were leased across the Las Vegas Valley. This is an 28.7% increase from November of 2021 (1,514 properties). The number of rental properties listed in November of 2022 was 1,885. This is a 75.8% increase from November of 2021 (1,072 properties). The median price of rental properties across the valley in November of 2022 was $1,925/mo. This represents a 1.6% increase from November of 2021 ($1,895/mo.). The average price of rental properties in November of 2022 was $2,108/mo. This is a 0.9% increase from November of 2021 ($2,089).

Here are the key takeaways for any real estate investor in the current market:

A) With consistent decreases in median and average rent month-over-month, and nominal increases in median and average rent year-over-year, it is safe to assume that the rent boom caused by COVID and the resurgence of the economy in Las Vegas has passed, and rent amounts are expected to remain stable or slightly decrease moving forward. If rent was not increased during the pandemic and years following, there is still space for a market adjustment at turnover or lease renewal, but do not expect the same kind of increases seen in 2021 and 2022.

B) As the market continues to slow, days on market (DOM) remains high for the Greater Las Vegas Metropolitan Area. In November of 2022, the MLS average DOM was over a month at 34 days. This means that when calculating yearly return on properties, turnover and vacancy are causing nearly a 10% reduction in gross income to the property owner. While some of this is offset by raised rental rates, it is still having a big effect on net ROI. If you are considering turning over the property, make sure that you are prepared for the rehab costs, along with the cost of unrealized rent while the property sits vacant. It may be smarter to keep a less than perfect tenant in the property until the market heats up during the summer to avoid those vacancy costs.

No matter the market conditions, every property is unique and needs a proper market analysis to determine what the current fair market rent would be. If you have questions about where your property fits into the current rental market, please reach out to us.