Las Vegas Housing Market Update - September 2022

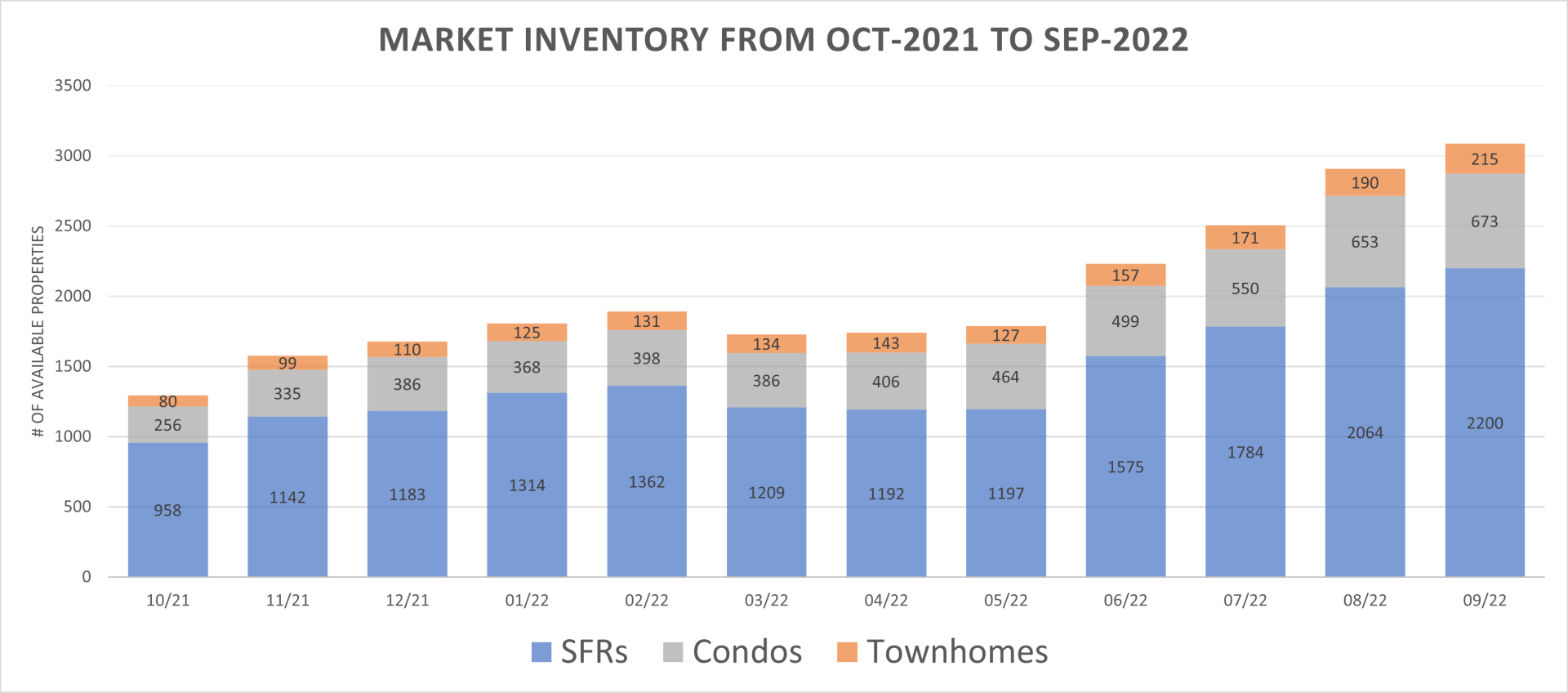

Real Estate Slow Down Means Inventory is Over 3,000!

At the end of September, rental market inventory officially crossed 3,000 rental properties with 3,088 active rental listings. Throughout October, this number has continued to increase to an almost ridiculous amount. As mentioned in previous updates, increased mortgage interest rates and a slowing of the sales market results in more owners using their property as a rental as opposed to selling. Additionally, the fall and winter are the slowest seasons of the year for the rental market, and inventory naturally increases around this time of year as there are less people looking to move during the school year and holiday season.

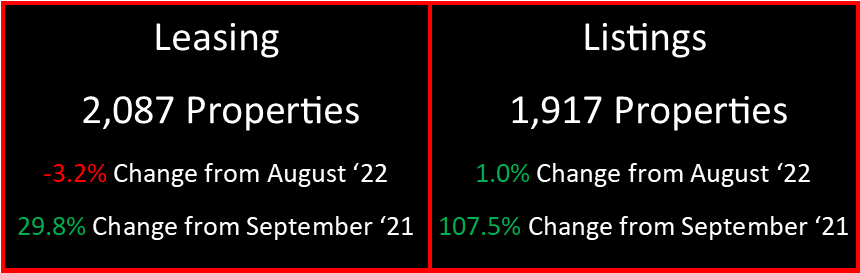

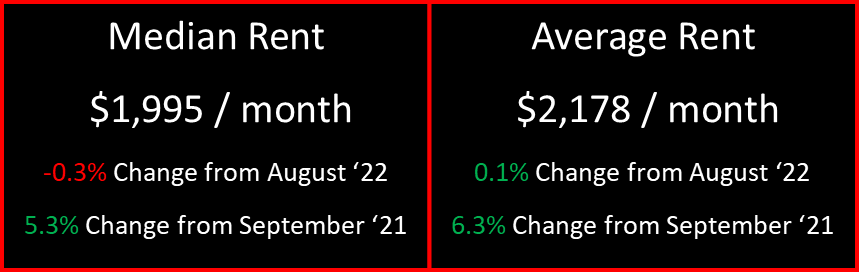

In September of 2022, 2,087 rental properties were leased across the Las Vegas Valley. This is an 29.8% increase from September of 2021 (1,608 properties). The number of rental properties listed in September of 2022 was 1,917. This is a 107.5% increase from September of 2021 (924 properties). The median price of rental properties across the valley in September of 2022 was $1,995/mo. This represents a 5.3% increase from September of 2021 ($1,895/mo.). The average price of rental properties in September of 2022 was $2,178/mo. This is an 6.3% increase from September of 2021 ($2,048).

Here are the key takeaways for any real estate investor in the current market:

A) Rent prices have stabilized with the median rent hovering around $2,000/month and average rent remaining fairly constant around $2,175/month. Moving forward, many lease renewals may not be able to secure the increase in rent that was seen during the busy summer months and during the pandemic. However, it is unlikely that we will see average rent prices decrease noticeably, barring a significant market event.

B) Due to increased inventory and stagnating rent, many rental listings are having to go through multiple price reductions to find a tenant. In fact, 53% of all leased rental properties in September had to go through at least 1 price reduction to get rented with 32% of those price reductions being greater than 10% of the initial rental listing price. These price reductions are caused by properties spending a longer time on the market, along with some landlords and property managers continuing to price their rental listings too aggressively.

No matter the market conditions, every property is unique and needs a proper market analysis to determine what the current fair market rent would be. If you have questions about where your property fits into the current rental market, please reach out to us.