Pandemic Apartment Construction is Finishing. Now What?

New Apartments Are Taking Longer to Fill Up

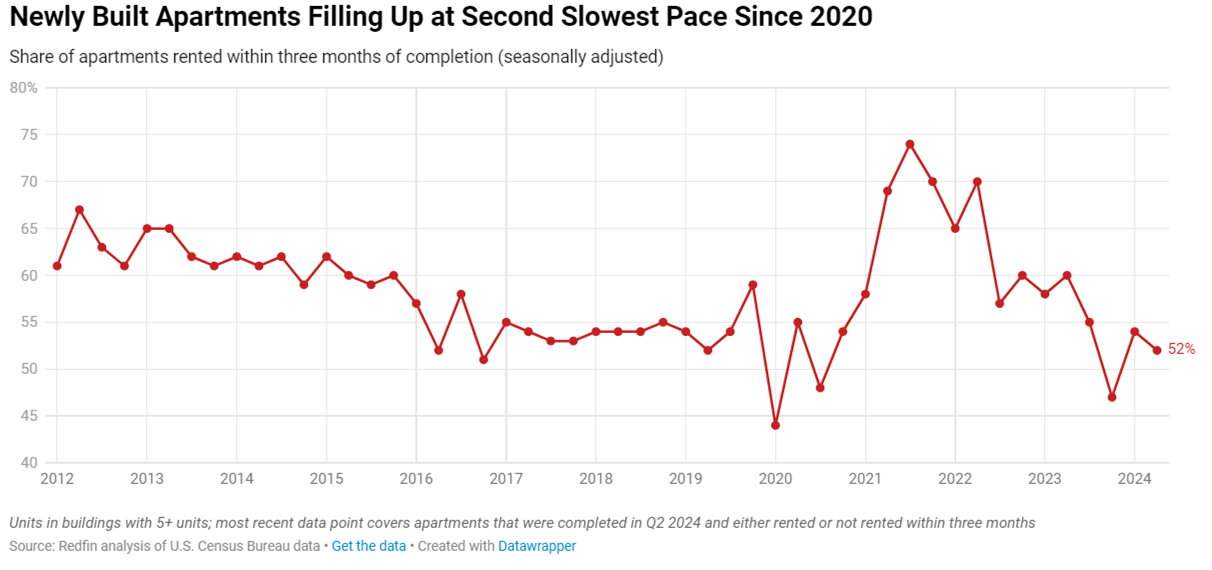

Remember how hard it was to find an apartment during the pandemic? Well, things are finally getting back to normal. New data shows that just over half of newly built apartments are finding renters within their first three months on the market. This is a big change from the crazy rush we saw during COVID-19.

Different Stories in Different Parts of the Country

The Northeast is doing surprisingly well – about two-thirds of new apartments there are getting rented quickly. But the South, especially Florida and Texas, is telling a different story. Builders went all-in on new apartments there during the pandemic when everyone was moving south. Now they might have built too many, too fast. Only about half of these new southern apartments are finding renters quickly.

Bigger Apartments Are a Hot Ticket

Here's something interesting: the biggest apartments (those with three or more bedrooms) are the easiest to rent out. About 63% of them find renters quickly, even though builders are making more of them than before. This makes sense when you think about how many people still work from home and want extra space.

Studio apartments, on the other hand, are having a harder time. Only half of them are finding renters in their first three months. One and two-bedroom apartments aren't doing much better.

What This Means for Potential Renters

If you're looking to rent, this is actually good news. With more apartments available and fewer people rushing to rent them, you might have:

- More choices when apartment hunting

- More room to negotiate your rent

- Better chances of finding move-in specials and deals

- The opportunity to rent a home instead of an apartment

Apartment complexes know this too. Many are offering special deals or lower rents to attract tenants. This is especially true in places like Florida and Texas, where lots of new apartments are opening up.

Looking Ahead

The apartment market is finally cooling down after the pandemic rush. Builders are slowing down too – they're starting fewer new apartment projects than last year. This means we're heading toward a more normal, balanced market where neither landlords nor renters have all the power. For 2025, this likely means better opportunities for renters, especially in areas with lots of new apartments. While finding an apartment isn't exactly easy, it's definitely not as stressful as it was during the pandemic. The best part? This calmer market means you can take more time to find the right place instead of having to grab the first apartment you see. Whether you're looking for your first apartment or thinking about moving to a new one, 2025 might be your year to find a great deal.