How Baby Boomer Home Ownership is Affecting the Market

Why We're Not Seeing a Housing Supply Boom

In recent years, there's been much speculation about the impact of aging baby boomers on the housing market. Many predicted a flood of homes hitting the market as this generation downsized or moved into retirement communities. However, the reality is proving to be quite different. Let's dive into why we're not seeing the expected "boomer boom" in housing supply.

Baby boomers, now aged 60 to 78, continue to hold substantial sway over the U.S. housing market. This generation owns a significant share of the country's homes, particularly larger properties with three or more bedrooms. Contrary to earlier predictions, however, they are not selling their homes in large numbers. Instead, many are opting to stay put for a variety of reasons.

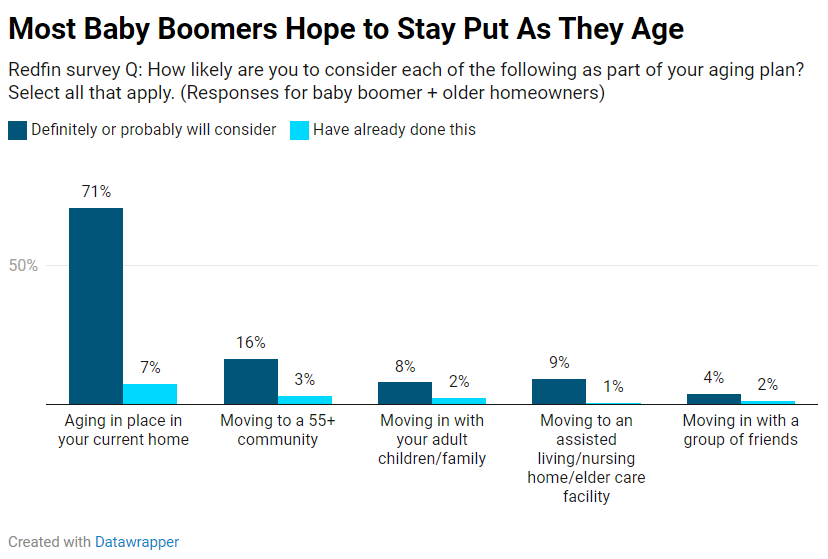

One key factor is the preference for aging in place. Many baby boomers choose the comfort and familiarity of their long-time homes rather than moving elsewhere. For those who do consider selling, financial disincentives often come into play. Over half of baby boomer homeowners own their homes outright, eliminating mortgage payments. Meanwhile, those who still have mortgages typically enjoy very low interest rates secured years ago. Selling in today's high-rate environment would likely result in higher borrowing costs, making the prospect less appealing. Additionally, the high costs associated with downsizing or relocating to retirement communities deter many from making a change.

This trend of baby boomers holding on to their homes impacts the housing market in several ways. One major effect is the inventory squeeze, which has made it challenging for younger generations, particularly millennials seeking family homes, to find available properties. However, experts project a gradual increase in supply as older homeowners inevitably sell their homes over time. According to the Mortgage Bankers Association, around 4 million existing homes from this demographic will enter the market annually through 2032. The growing demand from younger buyers and population growth is expected to absorb most of this supply increase, preventing a sudden market saturation.

Looking ahead, while baby boomers' influence on the housing market is notable, the expected shift is not as dramatic as some had anticipated. Demographic changes are projected to result in a modest excess supply of approximately 250,000 units per year over the next decade. However, the slow and steady nature of this transition is likely to have minimal impact on overall house price growth. The effects will vary by region, depending on local demographics and market conditions.

For potential buyers, sellers, and investors, these trends offer valuable insights. Buyers should not expect a sudden influx of available homes, especially larger family properties, as the market is likely to remain competitive. For baby boomers considering selling, this is an advantageous time, as demand for spacious homes in desirable locations remains strong. Investors, on the other hand, should monitor regional trends and factor in these long-term demographic shifts when planning their strategies.