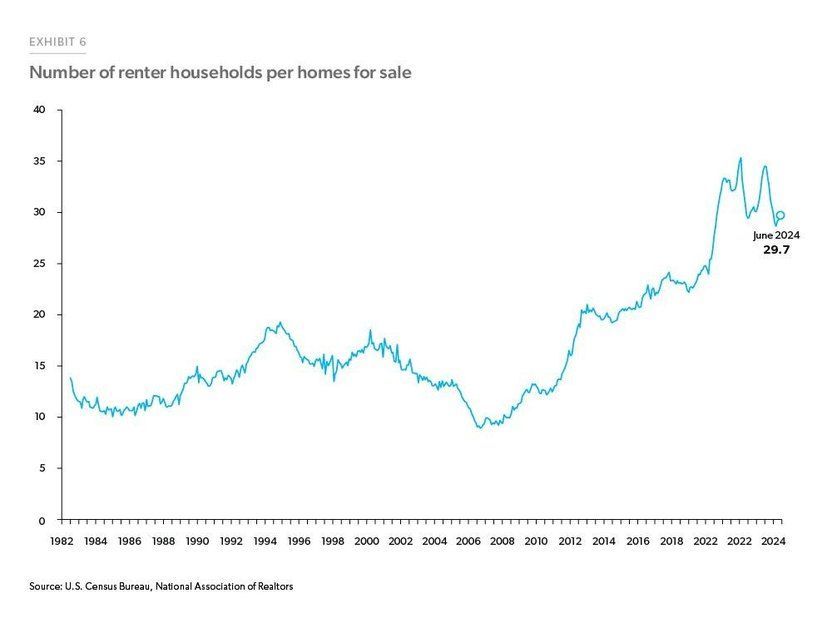

The Number of Renters per Available Home has Ballooned

First-Time Homebuyers Face Challenges Amid Low Inventory

The journey to homeownership in today’s market has become notably difficult, particularly for first-time buyers. One of the most daunting obstacles is the persistently low supply of homes for sale, creating a fierce competitive landscape. According to Freddie Mac's recent market outlook, there are currently around 30 renter households for every available home for sale in the United States—a significant jump from fewer than 10 per home in 2006. This disparity underscores the intense supply crunch that first-time buyers encounter as they seek to transition from renting to owning.

The roots of this supply shortage trace back to the Great Recession, which sharply curtailed new home construction across the country. Although building activity has slowly picked up since then, it has not kept pace with the growing demand for homes. Freddie Mac estimates the resulting shortfall is at least 1.5 million homes. This shortage not only inflates prices, but also forces new buyers to compete against a growing pool of would-be homeowners, amplifying the challenge of finding an affordable property.

Affordability Woes in the Starter Home Market

Affordability remains a central hurdle. Freddie Mac’s data highlights that from January 2000 to July 2024, the prices of entry-level homes have surged 63% faster than those of higher-end homes. This rapid increase in starter home prices disproportionately impacts first-time buyers, who often lack the substantial savings or wealth that can ease the financial burden of homeownership.

Moreover, historically high mortgage rates are adding to the strain. Following a brief dip in September, 30-year fixed mortgage rates have been on an upward trend, reaching 6.54% by the end of October, according to Freddie Mac. With elevated rates and climbing prices, the dream of homeownership feels increasingly out of reach for many renters.

The American Dream of Homeownership Persists—Despite the Challenges

A recent LendingTree survey underscores this sentiment, revealing that more than half of renters worry they may never achieve homeownership. Among those who want to buy, 65% point to down payment costs as their main barrier, while 52% say that home prices are too high in their desired areas. Additionally, 39% report that their credit score is an obstacle to securing a mortgage.

Even with these barriers, the desire for homeownership remains strong. The survey found that 83% of Americans would prefer owning a home over renting. This preference spans all demographics, including those with annual incomes below $30,000 (76%), Gen Z respondents (79%), and individuals without children (77%).

When asked why they wish to own, most respondents prioritize the personal freedom and stability it brings. Nearly two-thirds want the flexibility to make their own choices about their space, while a similar percentage values the stability that comes with not having to renew a lease. Financial reasons, such as wealth-building and property appreciation, rank lower in importance, cited by only 41% and 44% of respondents, respectively.

Renting vs. Buying: The Cost Comparison

It’s important to remember that while homeownership has many benefits, it comes with costs. In many markets, renting remains more affordable than purchasing a starter home, a consideration that prospective buyers should factor into their decision.

As the housing market remains challenging, the path to homeownership may require patience and strategic planning. For now, understanding these hurdles and planning accordingly can help first-time buyers navigate their options, keeping the dream of owning a home alive despite the odds.