Las Vegas Housing Market Update - December 2022

Inventory has Stalled, But DOM is Still Increasing

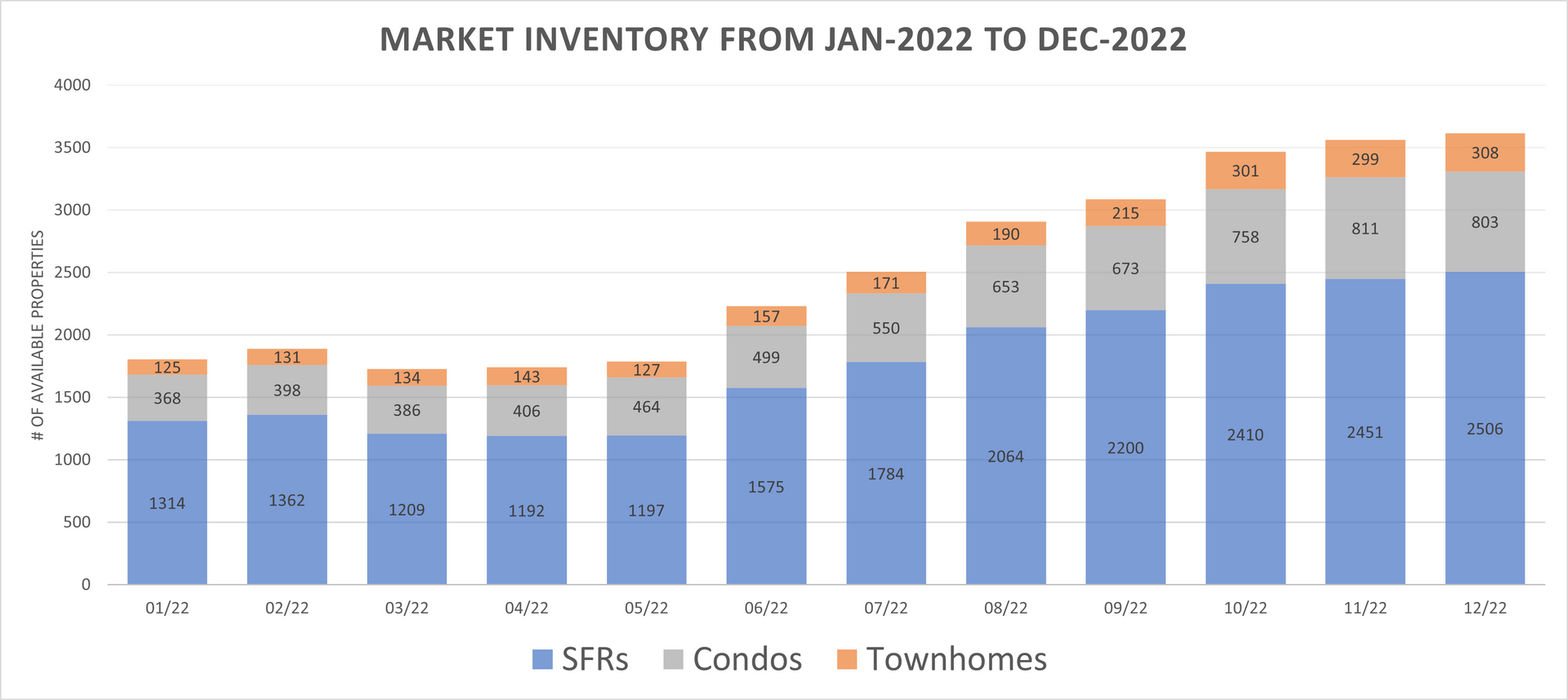

At the end of December, rental market inventory was at 3,617 rental properties. This new high continues the trend of ever-increasing inventory numbers that began back in June. While the rate of month-over-month growth has slowed dramatically since the summer, this level of inventory is far from what most agents are used to. the increased inventory in the second half of the year lead to an almost doubling of the MLS average DOM by the end of the year. In the time that McKenna Property Management has been keeping track of the average DOM for the MLS, the previous high DOM was set in January of 2020 and sat at 35 days. The new record of 40 days, set in December of 2022, is unprecedented and shows how high inventory can affect how quickly properties can move.

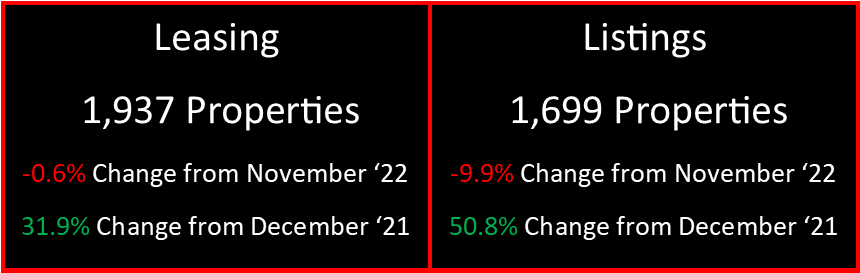

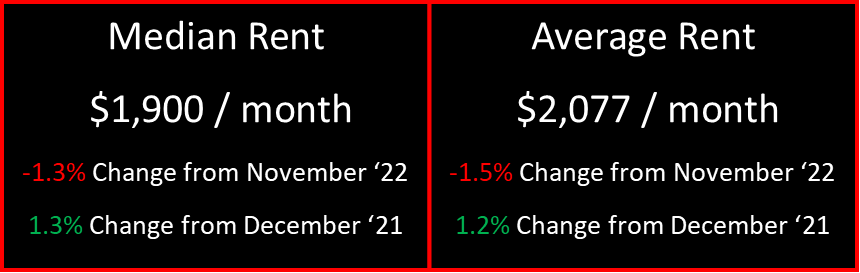

In December of 2022, 1,937 rental properties were leased across the Las Vegas Valley. This is an 31.9% increase from December of 2021 (1,468 properties). The number of rental properties listed in December of 2022 was 1,699. This is a 50.8% increase from December of 2021 (1,127 properties). The median price of rental properties across the valley in December of 2022 was $1,900/mo. This represents a 1.3% increase from December of 2021 ($1,875/mo.). The average price of rental properties in December of 2022 was $2,077/mo. This is a 1.2% increase from December of 2021 ($2,053).

Here are the key takeaways for any real estate investor in the current market:

A) With consistent decreases in median and average rent month-over-month, along with decreases in both leased and listed properties, it is safe to assume that the rent boom caused by COVID and the resurgence of the economy in Las Vegas has passed, and rent amounts are expected to continue to slightly decrease moving forward as the market corrects. If rent was not increased during the pandemic and years following, you may need to wait until the spring or summer for a market adjustment at turnover or lease renewal, but do not expect the same kind of increases seen in 2021 and 2022.

B) As the market stalls in the slow season, days on market (DOM) remains high for the Greater Las Vegas Metropolitan Area. In December of 2022, the MLS average DOM was a whopping 40 days. This means that when calculating yearly return on properties, turnover and vacancy are an over 10% reduction in gross income to the property owner. While some of this is offset by raised rental rates, the effect will only become worse as rents decrease and/or DOM continues to rise. If you are considering turning over the property, make sure that your rainy-day fund is prepared for the costs of turnover, along with the cost of unrealized rent while the property sits vacant. It may be smarter to keep a tenant in the property until the market (hopefully) picks up during the summer to avoid those vacancy costs.

No matter the market conditions, every property is unique and needs a proper market analysis to determine what the current fair market rent would be. If you have questions about where your property fits into the current rental market, please reach out to us.